In today’s fast-paced world, finding innovative ways to save money has become a huge concern for many individuals. With the raise of advanced AI technologies, such as ChatGPT, the possibilities for optimising your financial strategies have expanded greatly. As you know I am very passionate about saving and lately investing money, I have a great track of success in either. With my experience in this filed I dared to compile a comprehensive guide to help you maximize your savings using ChatGPT. Let’s explore a range of strategies, from budgeting advice to leveraging AI-powered insights, to help you achieve your financial goals.

Table of Contents

Smart AI Budgeting Techniques

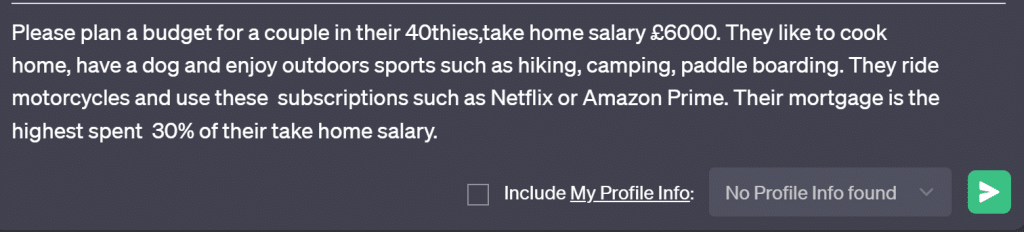

Efficient budgeting forms the foundation of successful money management. Gone are days of Excel or paper based budget management. By utilizing ChatGPT, you can take your budgeting skills to the next level. Start by outlining your monthly income and categorizing your expenses. It can be anything as simple as this:

Output: Certainly, I’d be happy to help you plan a budget for the couple based on the information provided. Here’s a breakdown of their budget:

1. Income:

- Take-home salary: £6,000

2. Fixed Expenses:

- Mortgage: £6,000 * 0.30 = £1,800

3. Utilities:

- Electricity, water, gas, internet, etc.: £200

4. Groceries:

- Since they enjoy cooking at home: £400

5. Transportation:

- Motorcycle-related expenses (fuel, maintenance, insurance): £300

- Public transportation (if applicable): £100

6. Pet Expenses:

- Dog food, vet visits, grooming, etc.: £100

7. Outdoor Activities:

- Hiking, camping, paddle boarding gear and trips: £300

8. Subscriptions:

- Netflix or Amazon Prime: £15

9. Entertainment/Fun Money:

- Going out, hobbies, etc.: £200

10. Emergency Fund/Savings:

- Aim for at least 10% of income: £600

Total Expenses:

- Mortgage: £1,800

- Utilities: £200

- Groceries: £400

- Transportation: £400

- Pet Expenses: £100

- Outdoor Activities: £300

- Subscriptions: £15

- Entertainment/Fun Money: £200

- Emergency Fund/Savings: £600

Total Expenses: £4,015

Remaining Income: £6,000 – £4,015 = £1,985

In this budget plan, the couple would have around £1,985 remaining after covering all their expenses. This leftover amount can be used for additional savings, investments, occasional splurges, or other financial goals they might have.

Remember that this is a basic budget plan and doesn’t account for every potential expense or situation. It’s important for the couple to regularly review and adjust their budget based on their actual spending and any changes in their financial situation. Additionally, setting aside money for unexpected expenses and long-term goals like retirement is crucial.

https://chat.openai.com/

ChatGPT can assist in identifying areas where you might be overspending, suggesting adjustments to optimize your budget allocation. This collaborative approach ensures that you’re making informed decisions tailored to your unique financial situation. It took ChatGPT 2 mins and I was quite happy with the outcome as it is ‘about right’. The main piece of info for me here is that this couple has £1985 of disposable income to invest! BINGO! Dont we love to know if we need to change anything or if we have any money to invest! Previously I used Emma and I still do but this is more to review my 8 bank accounts in one place. I also like Snoop as their AI analyses your spending habits and suggest optimisations. All great ideas how to rely on AI for budget management and optimisations.

AI-Powered Shopping Insights

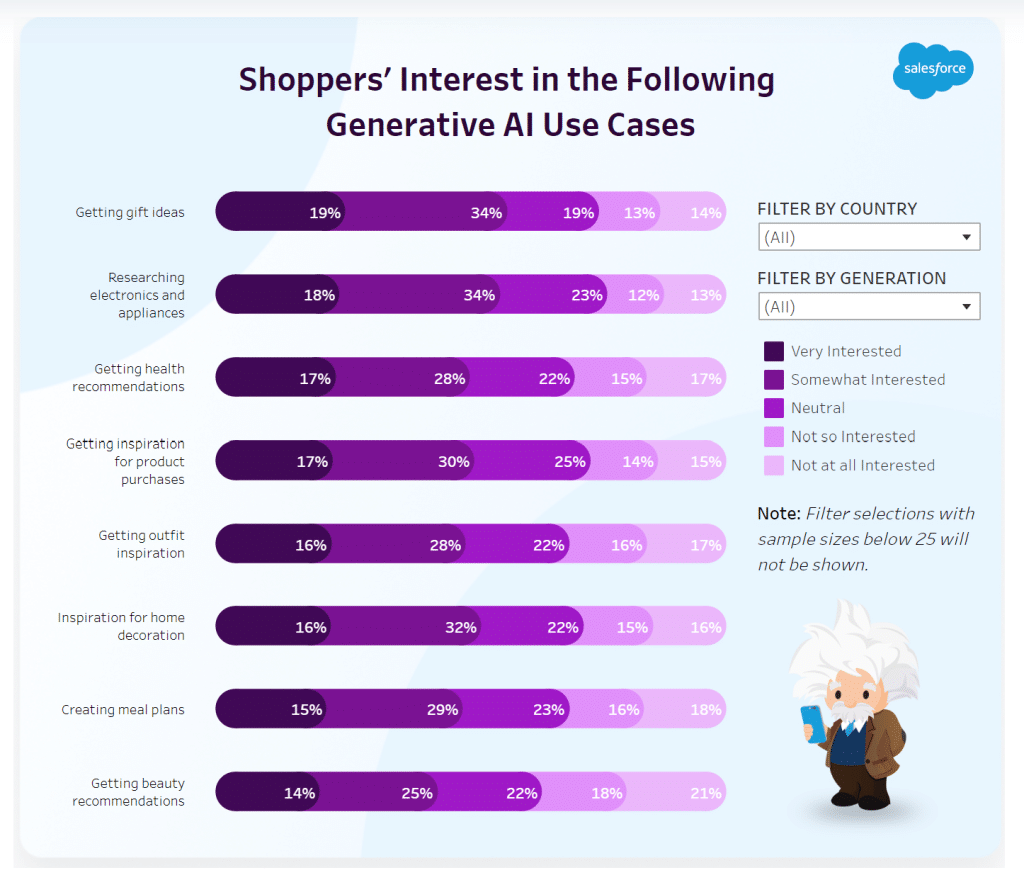

Online shopping has become an integral part of our modern lives, and ChatGPT can no doubt be your ultimate shopping companion. According to the latest reports from Salesforce:

‘35% say they’re interested in using generative AI for outfit and wardrobe inspiration and 43% say the same for researching appliances and electronics. 12% say they’ve already used generative AI for shopping inspiration.‘

It can analyze your spending patterns and recommend cost-effective alternatives for products you frequently purchase. For that reason, I recommend Snoop as then once you connect your bank account(s) to it it will analyse all the data seamlessly, whereas if you want to use ChatGPT I’d assume you need to paste your bank statement(s) for the AI to analyse any patterns. Well, this is for spending patterns based on what we know from our digital transactions. We can still use AI / ChatGPT’s insights to discover hidden deals, discounts, and even eco-friendly options that align with our preferences. This AI-driven assistance transforms your shopping experience into a frugal adventure. I personally love to use Google Lens as as I am a fussy shopper, so once I find something I love I buy more of it to avoid the pain of shopping in the future…Furthermore Google Lens is my price checker proxy – once I find a product I’m interested in buying, I screenshot/take a picture and upload to Google Lens to check if the price I am offered in any given shop is best possible. I also love using Microsoft Edge – watch my video explaining how quickly and easily it finds discount codes.

AI led Investment

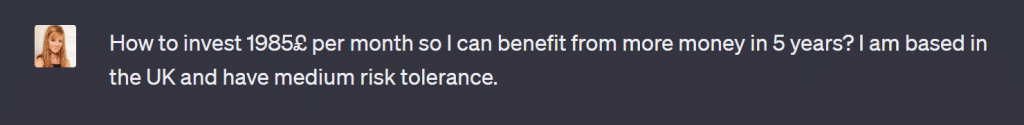

Investing wisely is key to long-term financial growth. ChatGPT can provide valuable information on investment opportunities based on your risk tolerance and financial objectives. Earlier on we had an example of a couple able to invest £1985 per month, lets see what ChatGPT can suggest as their investment options:

Output:

Investing is a great way to potentially grow your money over time. Since you have a medium risk tolerance and are looking to invest £1,985 per month for 5 years, here’s a general approach to consider:

1. Set Clear Goals: Define your financial goals for this investment. Are you saving for a specific purchase, retirement, or another milestone? Knowing your goals will help shape your investment strategy.

2. Diversification: Spread your investments across different asset classes to reduce risk. Consider a mix of stocks, bonds, and possibly other assets like real estate or commodities.

3. Investment Accounts: Open a Stocks and Shares ISA (Individual Savings Account) in the UK. This type of account provides tax advantages on your investment gains.

4. Choose Investments: Given your medium risk tolerance and a 5-year timeframe, a balanced portfolio might include a mix of equities (stocks) and fixed-income investments (bonds). This balance aims to capture potential growth while mitigating some risk.

- Equities (Stocks): Look into diversified equity funds or exchange-traded funds (ETFs) that track a broad market index. These can provide exposure to a range of companies and industries.

- Bonds: Consider government or corporate bonds for stability. Bonds can act as a buffer against market volatility.

5. Dollar-Cost Averaging: Instead of investing the entire £1,985 in a lump sum each month, consider spreading your investments over the month using a technique called dollar-cost averaging. This strategy can help reduce the impact of market fluctuations.

6. Review and Adjust: Regularly review your portfolio’s performance and make adjustments if necessary. As you approach your investment horizon, you might gradually shift your allocation towards more conservative investments to protect your gains.

7. Seek Professional Advice: Consult a financial advisor who specializes in medium-term investing in the UK. They can provide personalized advice based on your specific financial situation and goals.

Remember that all investments come with risks, and there’s no guaranteed return. Past performance is not indicative of future results. Market fluctuations can impact your investment value. It’s important to do thorough research, understand your investments, and make informed decisions.

Lastly, keep in mind that investment opportunities, regulations, and tax implications can change over time, so staying informed and adaptable is key to successful investing.

Whether you’re new to investing or a seasoned pro, ChatGPT’s expertise can offer insights into stocks, real estate, cryptocurrencies, and more. As the above is a rather generic example but we can query any stock, company, fund etc., further to get some more insights. Just be mindful that chatGPT doesnt offer up-to-date info as its repository cuts by 2021…Remember, while AI guidance is invaluable, always conduct thorough research before making any investment decisions. I personally wouldn’t rely on the ChatGPT for any decisions made on my behalf but I like the ideas it suggests and then I watch my friend James on YouTube to educate myself further re any particular investment type or to learn new tricks. As always it all is hugely subjective as everyone’s financial situation and life circumstances differ and therefore there is no one fits all advice here hence it is important to see a big picture(e.g. now interest rates in banks are great but if you are ahigh earner and pay a high tax the offers are not as tempting to you compared lets say to ISA – you see what I mean – always factor your unique situation into deciding what next)

Personalized Debt Management Strategies

Paying off debt is a significant step towards financial freedom. Engage ChatGPT to create a personalized debt repayment plan that aligns with your budget. Below shown is super random example:

Output: –> ok I see chat didn’t entirely got me as in included the APR now in the calculations but you get the idea here 🙂

To create a personalized debt repayment plan for a debt of £5,000 with a 10% APR (Annual Percentage Rate) that needs to be paid off in 12 months, let’s break down the process step by step:

1. Calculate Monthly Repayment:

Since the debt needs to be paid off in 12 months, you’ll need to divide the total debt by the number of months:

Monthly Repayment = Total Debt / Number of Months Monthly Repayment = £5,000 / 12 Monthly Repayment ≈ £416.67

2. Account for Interest:

The 10% APR means that the interest will be charged on the outstanding balance. To calculate the monthly interest amount, you can use the following formula:

Monthly Interest = (Outstanding Balance * APR) / 12 Monthly Interest = (£5,000 * 0.10) / 12 Monthly Interest ≈ £41.67

3. Total Monthly Payment:

To avoid any further charges and pay off the debt within the specified time frame, you’ll need to cover both the monthly repayment and the interest:

Total Monthly Payment = Monthly Repayment + Monthly Interest Total Monthly Payment ≈ £416.67 + £41.67 Total Monthly Payment ≈ £458.34

4. Create a Repayment Schedule:

Here’s how the repayment schedule might look:

- Month 1: £458.34 (Total Monthly Payment)

- Month 2: £458.34

- Month 3: £458.34

- …

- Month 12: £458.34 (Final payment)

By following this repayment schedule, you’ll be able to pay off the £5,000 debt within 12 months and avoid further charges. Keep in mind that this is a simplified calculation and doesn’t account for any potential fluctuations in interest rates or unexpected changes in your financial situation.

5. Monitor and Adjust:

Throughout the repayment period, it’s important to monitor your progress and ensure that you’re able to consistently make the required monthly payments. If your financial situation changes, you might need to adjust your budget or repayment plan accordingly.

Remember, the key to successfully repaying your debt is maintaining discipline and consistency in making payments. If you have any concerns or questions about your debt repayment plan, consider reaching out to your lender or a financial advisor for guidance.

If you put more data into chat based on real examples it’s data-driven approach considers your outstanding balances, interest rates, and available funds to propose an optimal payoff strategy. By following ChatGPT’s recommendations, you’ll be on the fast track to reducing debt and improving your credit score. BTW I see Halifax runs your credit score in their banking app 🙂

Amplifying Savings through AI-Driven Side Hustles

In the gig economy, side hustles have emerged as a means to boost income. ChatGPT can help identify potential side hustle opportunities based on your skills and interests. Whether it’s freelance writing, graphic design, or online tutoring, ChatGPT can offer insights into in-demand markets and suggest strategies for getting started. Diversifying your income streams has never been easier with AI-guided advice. Let’s see it in action here:

Output:

Certainly! Given your interests and personality traits as an introvert, there are several potential side hustle opportunities you could consider that align with your passions. Here are some ideas:

- Blogging or Vlogging: Create a blog or YouTube channel where you share your expertise in gardening, healthy lifestyle tips, cooking, and book recommendations. You can monetize your content through affiliate marketing, sponsored posts, or selling digital products like e-books or courses.

- Online Cooking Classes: Leverage your passion for cooking by offering online cooking classes or tutorials. Platforms like Udemy or Teachable allow you to create and sell your own courses, helping others learn to cook delicious and healthy meals.

- Dog Walking or Pet Sitting: Your love for dogs could translate into a dog walking or pet sitting business. Many pet owners are in need of reliable individuals to care for their pets while they’re away. This can also be a great way to spend time with dogs and earn some extra income.

- Gardening Consultation: Use your gardening expertise to offer gardening consultation services to individuals or businesses looking to improve their outdoor spaces. You can provide advice on plant selection, landscaping, and maintenance.

- Book or Podcast Reviewer: Start a blog, podcast, or YouTube channel where you review and discuss books, healthy lifestyle topics, or gardening techniques. As your audience grows, you can earn income through sponsorships, affiliate marketing, or crowdfunding.

- Freelance Writing: If you enjoy writing, consider offering your writing services as a freelancer. You can write articles, blog posts, or content related to your interests for websites, magazines, or online publications.

- Etsy Store: If you’re creatively inclined, you could start an Etsy store where you sell items related to your interests, such as gardening tools, healthy living planners, handmade crafts, or even dog-related products.

- Virtual Assistant: Use your organizational skills to become a virtual assistant for bloggers, podcasters, or small business owners. You can assist with tasks like content scheduling, social media management, and email correspondence.

- Content Creation for Businesses: Offer your content creation skills to businesses looking to improve their online presence. This could involve creating blog posts, social media content, or podcasts on topics related to your interests.

- Healthy Lifestyle Coaching: If you’re knowledgeable about healthy living, you could become a part-time healthy lifestyle coach. You can offer personalized advice and guidance to clients seeking to improve their health and wellness.

Remember that turning your passion into a side hustle takes time and effort. Start by identifying which idea resonates most with you and aligns with your skills. Research the market, create a plan, and start small. As you gain experience and build your reputation, your side hustle has the potential to grow into a profitable venture.

Ok, off to setting up my dog sitting business now….bye……no but seriously not bad ideas and actually I did dog sit last weekend and am doing it this weekend too! More as a favour to my friends than business but I certainly can do it :-).

Conclusion

Incorporating ChatGPT into your financial management journey can yield remarkable results. By harnessing the power of AI, you can streamline your budget, uncover hidden savings, make informed investment decisions, and embark on lucrative side hustles. As with everything, we work on the key to financial success lies in ones consistency and commitment when implementing these strategies. As you navigate the ever-changing landscape of personal finance, let ChatGPT and other AI based apps be your trusted guides to achieving your financial goals. Start optimizing your financial future today!

Money Saving Girl Money Saving Tips and Ideas

Money Saving Girl Money Saving Tips and Ideas